How is my Credit Score Calculated?

There are few things more confusing and more important to your personal finance goals than understanding how your credit score is calculated. This confusing, 3 digit number may not seem all that important, but when it comes time to get your first credit card, car, or maybe even buy a house, it can drastically affect how much you pay in the long run, if the bank will even let you get the loan. Now, don’t let that scare you. There are 5 basic components to a credit score and we’ll break them all down in a way that’s easy to understand and remember. So let’s get started!

What is a Credit Score?

Simply put, your credit score is a 3 digit, numerical evaluation of how good an individual is at taking on a debt (loan, credit card, etc.) and their ability to pay back the debt on time, also known as Credit Worthiness. This number is important because lenders and banks will use it to decide whether they will issue certain loans and credit cards to individuals and what percentage they will charge them in interest on the debt. Each person has there own individual credit score based off a number of factors we’ll get into shortly.

There are 3 major credit agencies in the United States that evaluate your credit scores. Those agencies are TransUnion, Experian, and Equifax. All these agencies use different metrics and information to generate your credit report and calculate your credit score, so you may notice differences in your credit score based on which agency you’re looking at. No agency is considered better than the other and lenders can use any or all of the different companies to review your Credit score so you want to review all of them regularly. You can get a free credit report once every 12 months from each of the three credit reporting agencies, so you should never have to pay for you credit score. You can usually view your credit score for free pretty easily and from many different sources. Most major banks provide free credit monitoring as long as you have a credit card with them which can allow you to view your credit score for free from their banking apps and websites. Again, and most important of all you should NEVER PAY FOR A CREDIT SCORE!

What is considered a Good Credit Score?

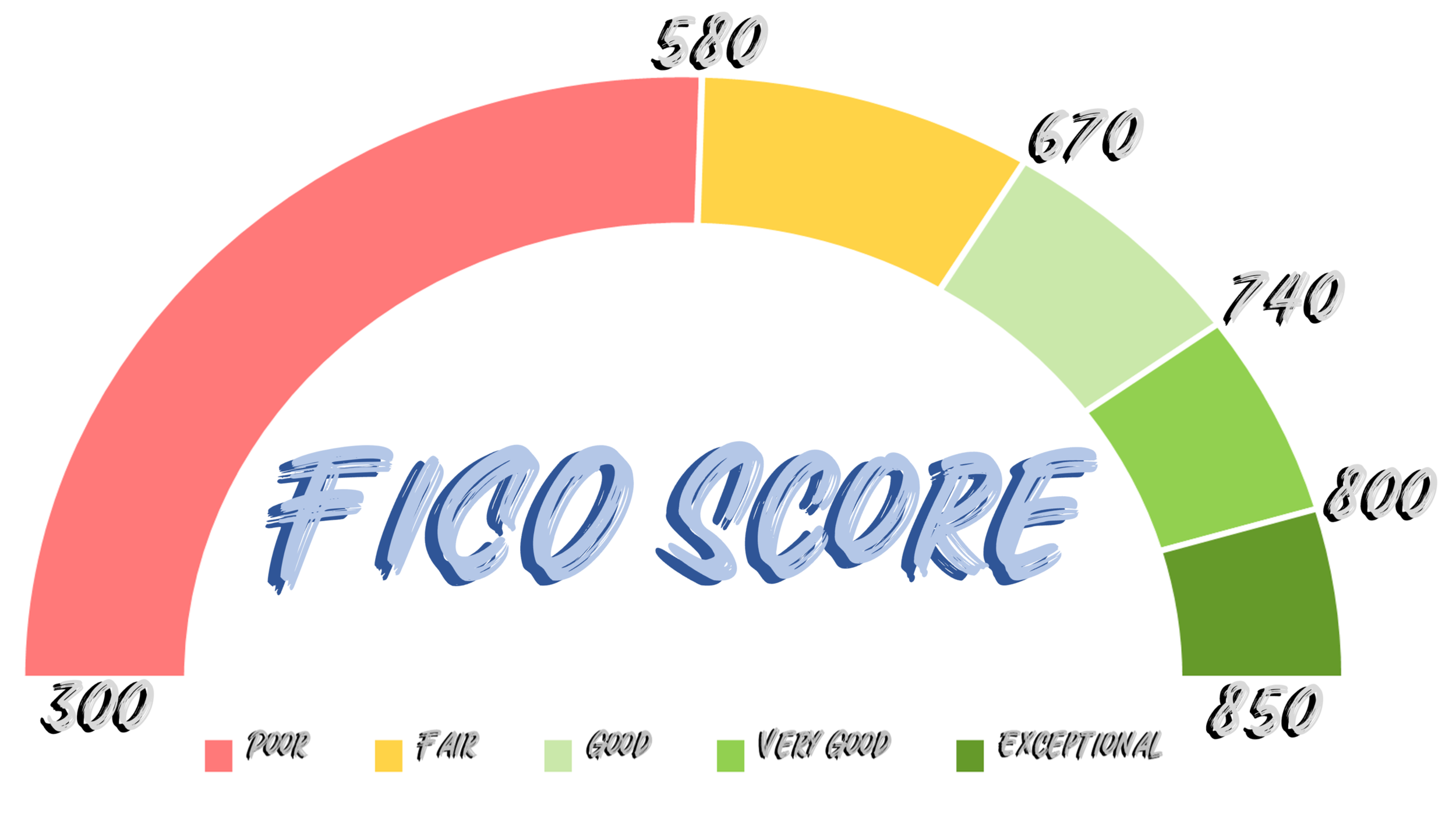

First, we have to determine the different ranges of a typical credit score, so we will focus on the FICO Score. Now, not all credit scores are FICO scores but we tend to care most about the FICO Score (FICO just stands for Fair Issac Corporation, the company who developed this type of score) because this score has been considered the Industry Standard for over 30 years . So, FICO scores range from a 300 on the lowest end to an 850 being the highest, as you can see from the graphic on the right. As you can also see, the breakdown in scores is as follows: Poor is from 300 to 579, Fair is from 580 to 669, Good is from 670 to 739, Very Good is from 740 to 799, and Exceptional (which we should all be striving for) is from 800 to 850.

Now, if you don’t know what your credit score is right this minute, I still recommend checking it, but odds are you have a 670 or better. According to Experian, roughly 67% of Americans have a Good FICO Score or better. There are many different types of scores with different ranges, but in general, the FICO Score is still considered the industry standard. Now, let’s say you’ve checked your score and realized it’s lower than a 670, that’s okay! There are lots of steps you can take to increase your credit score we’ll discuss in another post later on.

How is a Credit Score Calculated?

Well, let’s break it down into the 5 components from most weighted to least weighted; Payment History, Amounts Owed, Length of Credit History, Credit Mix, and New Credit.

Payment History - 35%

Let’s talk about payment history! Payment History is a measure of how timely you’ve been with paying your credit accounts over the length of your credit. Or more simply;

Pay your bills on Time = Good Score

Frequently Late = Bad Score

Now, the overall history of your credit is more valuable than one or two individual events. If you’re late on a payment once or twice, it won’t ruin your credit just like never being late doesn’t mean you’ll have a perfect score. This is just a portion of your credit score, although it is the highest weighted. That’s because research has shown people who frequently make timely payments are most likely to continue to pay their bills on time. Same is true for people who consider the payment due date as more of a “guideline” than a strict rule.

There are 7 components that make up your payment history:

Payment information on you credit cards and loans

How late you are on delinquent accounts or how delinquent you may become

The amount still owed on those late accounts

The number of delinquent accounts and overdue payment items

Any Adverse Public Records, like lawsuits or bankruptcy (yikes!)

The time difference from when you became late to when the score is reviewed

The number of “On-Time” accounts

These factors are all reviewed together to establish this portion of your score. Some are weighted more heavily than others. For example, filing for Bankruptcy is far more serious than the number of late payments. A bankruptcy will stay on your credit score for 7 to 10 years, where a few late payments will only be listed for a few months after repayment is made.

If you want to keep your payment history high, you need to pay your bills on time, repay any missed payments as soon as possible, and if you feel like you’re already in the hole on overdue payments, contact your creditors or a credit counseling service. They can often help you repay the debt faster by lowering interest rates or can help you make a budget to consolidate your debts.

Amounts Owed - 30%

Next, we’ll talk about amounts owed, also known as Credit Utilization. This is essentially a comparison of how much credit you have available compared to how much credit you use. So, to break that down, let’s say you have $10,000 of available credit across all your accounts. If you only use $1,000 of that available $10,000 (or 10%), your credit utilization looks Better than if you use $9,000 of that available $10,000 (or 90%), which is Worse. The general goal, according to most experts, is to keep your credit utilization below 30%, but you want to try to use as little credit as possible.

That being said, you also have a “grace period” to pay your debts which avoids turning them into revolving debt. For credit cards, the grace period is usually 30 days from due date to due date of your payments. If you pay the amount off in full on or before the due date, it will prevent that from turning into revolving debt.

Beyond how much credit you use, number of accounts is also factored in. If you have a lot of accounts with high significant amounts owed, this will indicate you could be at a higher risk of becoming over extended. However, as long as you limit your credit utilization to only what you need and pay that debt back, you’ll be fine.

Length of Credit History - 15%

After amount owed, we have Length of Credit History which is the amount of time you’ve been utilizing credit. Generally speaking, a long credit history is considered Better than a shorter history. This why you wouldn’t want to close your oldest credit account because that will reset your credit history. Of course, there is more to it than just that. There are 3 things considered when reviewing credit history.

Length Credit Accounts have been open, age of the oldest account, age of newest account, and average age of all accounts

Length each specific account has been open

Time since account has been used

Now, this can lead to a whole new problem; if you need a good FICO score to get credit, how do you get credit to build your FICO score. There are two generally recommended ways to start building credit. The first is to apply for a Secured Credit Card. A secured credit is just a card that has been backed up by cash locked in another account. For example, many banks will have you to put $1,000 in a Certificate of Deposit Account. This is a savings account that you can deposit into but can’t withdraw from until a specific date without penalty. After that, the bank will issue a credit card with $1,000 in credit. In other words, Amount in CD = Available Credit. The credit agencies review secured cards the same as any other credit card but it allows banks to feel safe issuing you credit when you have no proven history.

The other way is to have a friend or family member with good credit to make you an Authorized User. The way this works is the individual with good credit essentially has the bank issue you one of their cards in your name so that you can start building your own credit. Now, you both have individual credit cards, but they’re tied to the same account. If someone is asking you to make them an authorized user, BE CAREFUL and make sure you trust them fully. You are still fully responsible for the account you have added them to and responsible for all of their purchases as well. If they aren’t making their payments on time, this will hurt your credit score too. So, make sure you trust someone before giving them access to your credit accounts.

Credit Mix - 10%

The first 10% component of your score will be credit mix. Simply put, this is an evaluation of the different types of credit accounts you possess. This could include credit cards, installment or mortgage loans, and retail accounts. In general, the better you are at managing different credit type the Better your score. This means having different types of credit which you pay on time, the less risky you appear to lenders. Of course, credit mix only accounts for 10% of your score, so this likely won’t affect your score much, but there are two types of credit to consider; revolving and installment accounts.

Revolving accounts are the accounts which have flexibility in their monthly payments in regards to minimum payment, due dates, and so on. These include;

Credit Cards

Retail Cards

Gas Station Cards

HELOC (Home Equity Line of Credit) - Credit taken against the value of your home

Installment accounts are the accounts which have fixed monthly payments until the balance is paid down. These are your more traditional loans, to include;

Mortgage Loan

Auto Loan

Student Loan

New Credit - 10%

Finally, we have New Credit. This refers to credit inquiries, or reviews of your credit by lenders, that have been made in the last 12 months. These occur whenever you apply for new credit and inquires can remain on your report for two years. 3 things that affect New Credit are;

Number of new accounts you have

Number of recent inquiries

Time since most recent account open

To break that down a bit, if you open a lot of new credit all at once, that may lead lenders to think you are in desperate need of credit and, therefore, a credit risk. So, too many new accounts too quickly leads to Worsening Score. For number of recent inquiries, FICO only looks at the last 12 months but hard inquiries can remain on your report for 2 years. Generally though, most inquiries make a small impact or are ignored completely to allow “rate shopping”. Most important of all with inquiries is to remember it is OKAY to check your own credit report! Checking your own report won’t affect your score, and you can get a free copy of your report from each agency once a year.

So, opening New Credit helps your score because it allows you to generate a diversified Credit Mix. However, as stated above, New Credit can hurt your score by opening too many new accounts too quickly which will make you appear as a credit risk.

The Wrap-Up

All in all, it’s important to remember that your credit score is calculated from many different factors. Generally speaking, to Improve your score, you want to;

Open Credit Accounts Early

Pay off your Accounts On Time

Use Less than 30% of your Available Credit

Avoid Closing Credit Cards unless you have High Annual Fees

Have a Diversified Credit Mix

Avoid Opening a lot of New Credit very Rapidly

There are more fine details you can get into in order to improve your score, but if you focus on these main tips, you can have a great credit score. Even if you’ve made mistakes in the past, your credit score is regularly evaluated and, with time, you can fix those mistakes. Just keep up with and continue to educate yourself. Financial Literacy is the number 1 key to Financial Success.

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.