New Posts Available Every Thursday!

Get Awesome Money Tips in your Inbox!

Sign up to get the Latest and Greatest Awesome Money Tips posts Directly in your Inbox!

The 7 Stages of Financial Independence

“It takes time to reach ideal financial freedom. There are typically 7 different stages of Financial Independence but everyone’s path is different. This is the most realistic path for the average person to reach Financial Independence.”

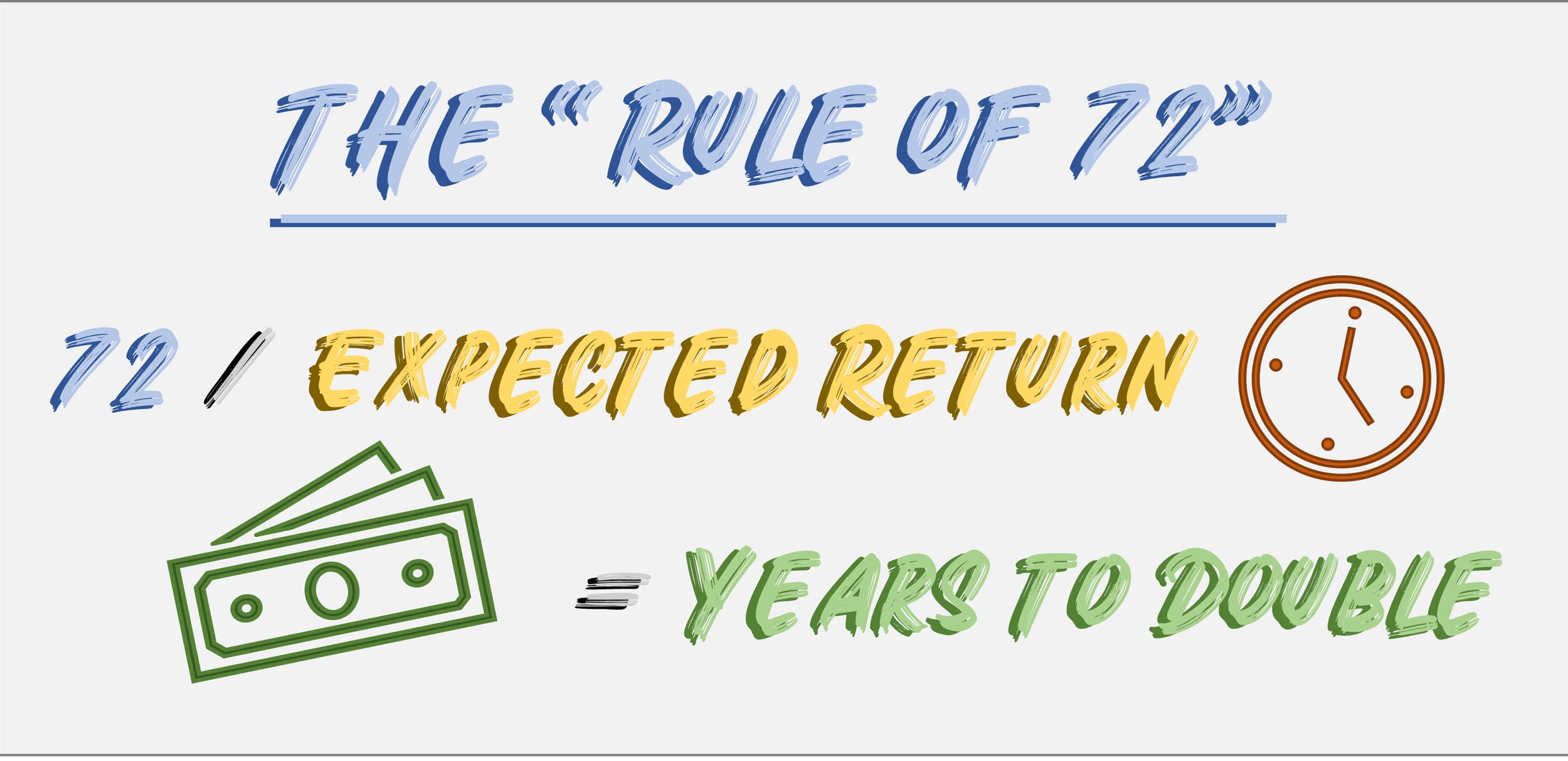

The “Rule of 72” and How it Works

The “Rule of 72” is actually a formula which can let you know either how long in years an investment will take to double at a specific rate or what rate of return you need for an investment to double over a specific timeframe. Essentially, if you know either an expected rate of return or a timeframe you hope your investment to double in, you can solve for the other value.

Major Changes to 401(k), TSP, and IRA Contributions in 2023

“In 2023, we’re going to see some of the largest changes to Retirement Account Contribution Limits we’ve ever seen. Not only will these contribution limits increase, but eligibility for higher income individuals to make IRA contributions or receive tax deductions on those contributions has also increased!”

The 5 Different Types of Financial FIRE

“In fact, there are many different types of FIRE with different methods and goals for how to get there. We’ll talk about the 5 most common now!”

How to Split Finances in a Relationship: The 50/50 Method or The Income Percentage Split Method

“Unfortunately, the second leading cause of divorce after infidelity is dispute over finances. One way some couples try and avoid this is by separating their finances. There are a few ways to go about this, but since most “serious” couples tend to end up living together, they will inevitably end up with some shared expenses. The two most common methods are the 50/50 and Income Percentage Splits.”

The 5 Essential Financial Accounts You Need and How Much to Contribute to Each

“5 Types of Financial Accounts which can help you in any financial strategy. Understanding these accounts is essential even if your financial position or goals change in the future. I’ll also explain how you can strategize contributions to these accounts in a medium to low risk way that can help you better reach your different financial goals. So let’s get into it!”

Health Savings Accounts Explained: Investing in your Health

“Typically when we think of Tax Advantaged accounts, we think of 401(k)s and Roth IRAs… but there are also accounts to help invest for Health Expenses. In the US, we generally receive Health Insurance from our employer. So what can you do if you’re self employed or retire early? This is where an HSA can come in handy.”

How Personal Income Taxes Work!(in the US at Least…)

As the famous Benjamin Franklin quote goes; “In this World, Nothing is Certain except Death and Taxes.” Unfortunately, the Internal Revenue Service (IRS) and our exceptionally complicated tax code make it extremely difficult to understand. Not everyone has to deal with the same types of taxes, but one is quite common; Personal Income Tax. If you make money in the US, then the Government is getting a piece. But what really are Personal Income Taxes and how do they work?

Dividends Explained: Investing for Cash Flow

“In any strategy, one thing to consider for at least supplementing your portfolio is dividend stocks and how they may help your portfolio grow.”

The 50/30/20 Rule Explained: Will it Work for You?

“Trying to establish a budget can be hard. Just like a diet, there’s a bunch of advice out there on how to save more, make more money, and where to cut back. Finding a simple rule to ensure you will be fine in retirement may seem confusing, but the 50/30/20 Rule actually does make it easy.”

5 Simple Strategies to Save More Money NOW!!!

With Inflation at a 40 year high, a falling GDP, and frequent layoffs, there is no better time than now to start Saving More Money! These 5 Simple Strategies are ones you can start RIGHT NOW at NO COST to you! You can’t afford to wait!

The “Big 3” Different Types of Mortgages

“There are WAY more types of Mortgage loans than just three. Too many to put in one post. However, we’re going to focus on 3 Main types. The “Big 3”! These “Big 3” are the mortgage starting blocks; Conventional Loans, FHA Loans, and VA Loans.”

ETFs Explained: How to Get Rich Slowly!

“Often touted as the “Smart way to buy into the Stock Market”, ETFs are considered one of the best and easiest ways for beginners to start investing. But why is that? What does ETF even stand for, what are they, and how can they help you get rich? Well, let’s get into it.”

Boost your Credit Score Now in 6 Easy Steps!

“Building Good Credit is one of those things many people don’t understand. It’s a subject commonly avoided, like asking someone their salary. But honestly, building good credit is something anyone can do with a little understanding and discipline. These tips can help you go from No Credit (or bad Credit) to Good Credit Fast!”

The American Express Platinum Card: Why EVERY Military Service Member Should Get One!

“The Infamous American Express Platinum card… That shiny, stainless steel metal credit card that can make you feel powerful when you slam it down on the bar to buy a drink. This iconic card is one of the most recognizable credit cards out there because it’s so exclusive. You may be asking, if it’s so “Exclusive” why should EVERY military service members get this card?”

Baby on the Way? 3 Amazon Tips to Save for your Little One! | Financial Fatherhood

“As I type this, my first child is due just a little over 2 weeks from now and, as a personal finance fanatic (a.k.a. Cheapskate), I wanted to find the best ways I can save some money for all the items my wife and I will need for his arrival without sacrificing quality and safety. Kids can be expensive! According to different studies, your baby’s first year can cost anywhere from $10,000 to $15,000 so finding ways to save can be critical to reach your financial goals. What I found is Amazon.com can actually be a great tool to help you save!”

Inflation Explained: What is it and Should we be Worried?

“The Consumer Price Index (CPI) just hit a 9.1% Increase over the last year, the highest increase since 1981 and significantly higher than the predicted 8.8% increase experts were expecting. But what does this mean? What is Inflation, or even the Consumer Price Index for that matter? How do we calculate inflation? What is causing Inflation? And is inflation something we should worry about?”

The Issues with Crypto Today: Should you still Invest?

“If you’ve been paying attention to “Crypto News”, I’m sure you’ve seen the doom and gloom Headlines. The Market Crash had led to layoffs at exchanges like Gemini and Crypto.com. Even worse, you have other exchanges and lenders, like Celsius and Vauld, who have suspended withdrawals and there is fears they may soon declare bankruptcy. These are some scary times… So, what could be causing this?”

Avalanche vs Snowball Debt Repayment Methods: The Good, The Bad, and The Side-by-Side

“Debt… The Destroyer of Financial Stability. High Interest debt especially can erode ones ability to save for retirement, plan for emergencies, or even get so bad they can’t pay their bills. Getting rid of that high interest debt is key to developing financial stability. Two main methods experts talk about for this are the Avalanche Method and Snowball Method.”

What is a “Recession” and How do we Thrive in It?

“At a recent congressional hearing, Federal Reserve Chair, Jerome Powell, finally acknowledged that the steps being taken to curb inflation may lead us into a recession. The big, scary “R” word… Even Cardi B has been tweeting about it. But what actually is a Recession? How much does it affect the average person? And what steps should we take to get through one?”

Get Awesome Money Tips in you Inbox!

Sign up with your email address to receive the Latest and Greatest Awesome Money Tips Post directly in your inbox!