Inflation Explained: What is it and Should we be Worried?

The Consumer Price Index (CPI) just hit a 9.1% Increase over the last year, the highest increase since 1981 and significantly higher than the predicted 8.8% increase experts were expecting. But what does this mean? What is Inflation, or even the Consumer Price Index for that matter? How do we calculate inflation? What is causing Inflation? And is inflation something we should worry about? Well, let’s get into it and find out.

What is Inflation?

Inflation is the measure of the increase in price for all goods and services throughout the economy. In other words, it’s how much more things cost than the year before. It can also be described as a decrease in Purchasing Power. Purchasing power is the strength a currency has measured by the quantity of goods or services it can acquire. Simply put, as Inflation Increases, Purchasing Power Decreases.

How do we Calculate Inflation?

Inflation as a whole is usually measured by taking a diverse collection of goods or services, called a basket, and comparing the change in price over time. In the United States, we generally focus on the Consumer Price Index (CPI), released monthly and calculated by the US Bureau of Labor Statistics (BLS). The CPI focuses on a basket of goods involving food, housing, apparel, transportation, medical care, recreation, education and communication, and other goods to take a weighted average that represents an aggregate of US Consumer spending. To do this, the BLS collects prices from 75 urban areas, 6,000 housing units and quotes from 22,000 retailers to cover roughly 93% of the population. The CPI is also aggregated by weight, or measured by the importance in spending to the appropriate population. They also make adjustments for updated features to products that weren’t available previously, lower quality products to switch to during economic distress, and some collections are made through polling which may not be accurate. Due to these adjustments, some experts critique the CPI as understating the true nature of inflation. If you want to review the June 2022 CPI data, you can click the link here.

What Causes Inflation?

Now, this is much harder to determine. There are plenty of factors that can effect inflation from fiscal policy to international conflicts to even global pandemics, like we’ve seen recently. Since there are so many minor factors, we’ll focus on the three mechanisms which drive inflation; Demand-Pull Effect, Cost-Push Effect, and Built-In Effect.

Demand-Pull Effect

Demand-Pull Effect occurs when an increase in the money supply and/or a decrease in debt costs allows for an increase in demand for products.

So to break this down. Let’s say a nice pair of “La Shoe” shoes is normally priced at $100 and the “La Shoe” company can make 10 shoes a month at that price. Luckily, their typical customers only buy about 10 shoes a month. Then all of sudden, the average salary of their customers increases by $10,000 a year. This leads to 30 new customers this month wanting their own “La Shoe” shoes, but “La Shoe” can only make 10 shoes at $100 a month. Since the demand for “La Shoe” has increased, they need to raise the price to make more shoes to the new demand.

The same can occur if the cost of debt decreases. For example, if mortgage rates drop from 6% to 3%, the monthly payment for a $300,000 house would drop from $1,800 a month to $1,265 a month. This would make home ownership significantly more affordable. Now more people can afford houses, but new houses aren’t being made, the price of the houses on the market will increase as people begin to outbid each other.

This is one factor that may have attributed to current inflation. During the pandemic, government stimulus and lower interest rates could have allowed for increased demand for those still making regular income. This increased cash and cheaper borrowing made things more affordable but caused companies to have to raise prices later on to keep up with increasing demand. This can easily be seen by the drastic changes in the housing market.

Cost-Push Effect

Cost-Push Effect is where an increase in production costs leads to companies “pushing the cost” onto consumers by raising prices.

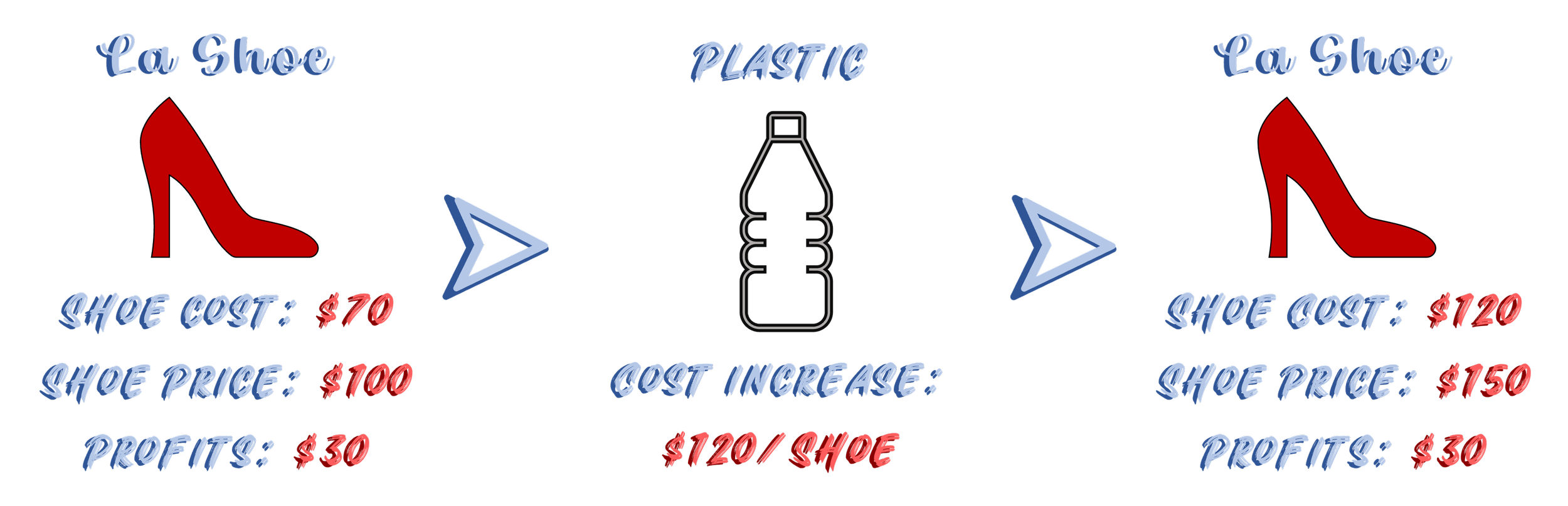

So if we continue with the “La Shoe” example, let’s say the cost to make a pair of $100 “La Shoe” Shoes is $70, netting a nice $30 profit per pair. Unfortunately, due to an increase cost of gasoline, it costs $120 to make the plastic for the shoes. If the company kept selling at $100 a pair, the “La Shoe” Company would lose $20 a pair sold. So to keep profits the same, they have to raise the cost of a pair of shoes to $150 a pair.

For recent examples, the supply chain issues and worker shortages have led to increased costs in production. The lack of truck drivers and manufacturers have made it more expensive to produce products. Also, a lack of availability of necessary products like micro chips and increased costs of materials such as copper have delayed production and increased costs further down the line for cars, cell phones, etc and has also made them more expensive. Some of the issues may have led to the extreme inflation we’re seeing today.

Built-In Effect

Built-In Effect is simply the inflation created by the expectation that there will be inflation. As the price for goods increases, workers expect to be paid more leading to a cyclical effect that causes Inflation to continue. Inflation is normal. In fact, it’s so normal that one of the goals of the Federal Reserve is to keep inflation at a maximum of 2% annual increase.

Should we Worry about Inflation?

The tough answer is it depends. As said above, inflation is normal and a 2% to 3% annual increase in inflation is nothing to worry about. Runaway Inflation is a worry. As said above, one goal of the Fed is to keep inflation normal but when they can’t, that can be scary. This is because high inflation has trickling effects:

Salary Raises may not be able to Account for Inflation. If your salary increases by 5% but Inflation increases by 9%, the purchasing power of your money actually decreases by 4%

Consumer Sentiment (or a willingness for individuals to buy products) can decrease, especially for high ticket items

Higher costs for necessary expenses makes it harder to save and invest for the future

The Fed may need to Hike Interest Rates Drastically to slow inflation. This makes borrowing much more Expensive (High Mortgage Interest Rates and Personal Loans)

Companies also borrow left, Slowing Growth and often decreasing Stock Value

Slowing Growth and Lack of Consumer Sentiment can lead to Layoffs to protect Profits

Add all this together, and you can end up in a Recession

So on it’s surface, inflation isn’t a worry but it can be a leading sign of a Recession and a recession can have significant impacts. If you want to learn more about what a recession is and how to survive one, you can click this link here.

Most importantly, if you’re worried about high inflation, do your best to continue to save for emergencies, cutback where you can, and contact a certified Financial Planner if you’re really worried. If you’re not ready for that, just keep learning. Financial Literacy is the Number 1 Key to Financial Success so it always helps the more you know.

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.