How Personal Income Taxes Work!(in the US at Least…)

As the famous Benjamin Franklin quote goes;

“In this World, Nothing is Certain except Death and Taxes.”

Unfortunately, the Internal Revenue Service (IRS) and our exceptionally complicated tax code make it extremely difficult to understand. There are tax systems set up to collect on anything from Property to Consumption to Inheritance and even prizes, like the Lottery! Even if you win on “The Price is Right”, you’ll find old Uncle Sam has to take his cut. Of course, not everyone has to deal with the same types of taxes, but one is quite common for pretty much everyone; Personal Income Tax. If you make money in the US, then the Government is getting a piece. But what really are Personal Income Taxes and how do they work?

What are Income Taxes?

Income Taxes are taxes paid by individuals to the government based on how much money they make. In other words, it’s the money you owe the Government for the privilege of making money in their Country. This may seem like a weird policy, but most countries in the world charge some form of Income Tax, with the exceptions of Bermuda, the Bahamas, Monaco, and the United Arab Emirates (UAE).

Income taxes aren’t only collected from individuals though. They are also collected from Businesses and Corporations, including small business owners and self-employed individuals. These generally apply less to the individual person so we’ll focus on Personal Income Taxes (a.k.a. Individual Income Taxes), which are the taxes each person making income has to pay. Basically, if you make money in the US, you have to pay.

Who Collects Income Taxes?

Income Taxes are collected by the Federal Government through the Internal Revenue Service (IRS) and some state and local governments. So, everyone earning income in the US will pay Federal Income Taxes, but each state is different. There are 8 State with Zero Income Taxes;

Alaska

Florida

Nevada

South Dakota

Texas

Tennessee

Washington

Wyoming

Now, New Hampshire has a 5% tax on Dividend or Interest Income, but that is expected to be repealed in 2024. For the other states, income taxes are charged very differently. For example, California has a 12.2% Income Tax with an additional 1% for those making over $1 Million dollars while on the other hand, Pennsylvania charges a flat 3.07% Tax Rate. Since every state is so different, we’ll just focus on Federal Income taxes.

How is your Federal Income Tax Calculated?

*Spoiler Alert* We are just going to be talking about the Basics of Income Taxes! Trying to break down every form of taxable income, available deduction, and new tax credit that may apply to you would make up a whole book and it does. In fact, it’s two books actually and together they’re called The US Tax Code. “The Code” comes in two volumes, composed of 1,404 pages and 1,248 pages respectively. (Yikes…) For most people, the basics are all you need to understand to make some smart investing decisions.

1) Calculate Taxable Income

So, you’re Taxable Income is calculated in Three Steps; Gross Income, Adjusted Gross Income, and Deductions. This is how they work.

1) Gross Income - This is your Total Income Received. This means all the money you receive from every source, from your salary pay to bank interest to dividend income. Now, some of this income will be considered Ordinary Income while others will be considered Capital Gains. Both contribute to your income taxes but in different ways which we’ll get into later.

Total Income Received = Gross Income

2) Adjusted Gross Income (AGI) - This is your Income after Adjustments, which is sometimes also called “Above-the-Line Deductions”. These adjustments allow you to remove certain types of income that isn’t qualified as taxable. Since they’re not taxable they will not be included, such as Scholarships, Alimony or Child Support Payments, and Contributions to Retirement Accounts (401k). For a recent example, the Pandemic Stimulus was money most people received but wasn’t considered taxable, so you didn’t owe any portion back to the Government.

Gross Income - Adjustments = Adjusted Gross Income (AGI)

3) Deductions - Now we use Expenses on Earned Income as a final way to reduce your total income. Also called “Below-the-Line Deductions”, this is where individuals can list certain expenses they have to pay in order to make income. For example, if you work from home online, you might be able to deduct your Wi-Fi Bill from your taxes. There are two main ways for individuals to claim deductions; Itemized Deductions and Standard Deduction.

Itemized Deductions - This is where you list every deductible expense individually. So if you’re a photographer, you might be able to deduct your camera, cost of film, your car payments if it gets you to photo shoots, etc.

Standard Deduction - In an attempt to make taxes easier, the IRS offers a standard deduction which anyone can apply for based off their specific situation. This is the most common deduction, with an estimated 90% of Tax Filers using the Standard Deduction. In 2022, the Standard Deduction Rates are as follows;

One thing to remember is that, once you choose a deduction, you can not also use the other. So, if you choose to Itemize and it’s less than $12,950 worth of deductions, you can’t also choose the Standard Deduction. Because of this, you want to use the highest valued deduction. After you determine that, you subtract it from the AGI and that bring you to your Taxable Income.

Adjusted Gross Income (AGI) - Deductions = Taxable Income

An Example: Let’s assume your job pays you $50,000, the match 1% of 401(k) Contributions which equals $500, your High Yield Savings Account paid you $500 in interest, your dividend investments paid you $1,000 this year, and you sold some stocks you’ve been holding for a few years for a big return of $1,000.

1) Gross Income = $50,000 + $500 + $500 + $1,000 + $1,000 = $53,000

Now you contribute to a Roth 401(k), so your contributions are taxed, but the matching is not. So your AGI would be;

2) Adjusted Gross Income = $52,000 - $500 = $52,500

Lastly, you compare your Itemized Deductions and the Standard and realized your single, standard deduction is significantly higher so you choose that;

3) Taxable Income = $52,500 - $12,950 = $39,550

So even though you made $53,000 in Income, you only owe taxes on $39,550. But now we know how much income we owe taxes on, how much do we pay?

2) Calculate Effective Tax Rate Owed

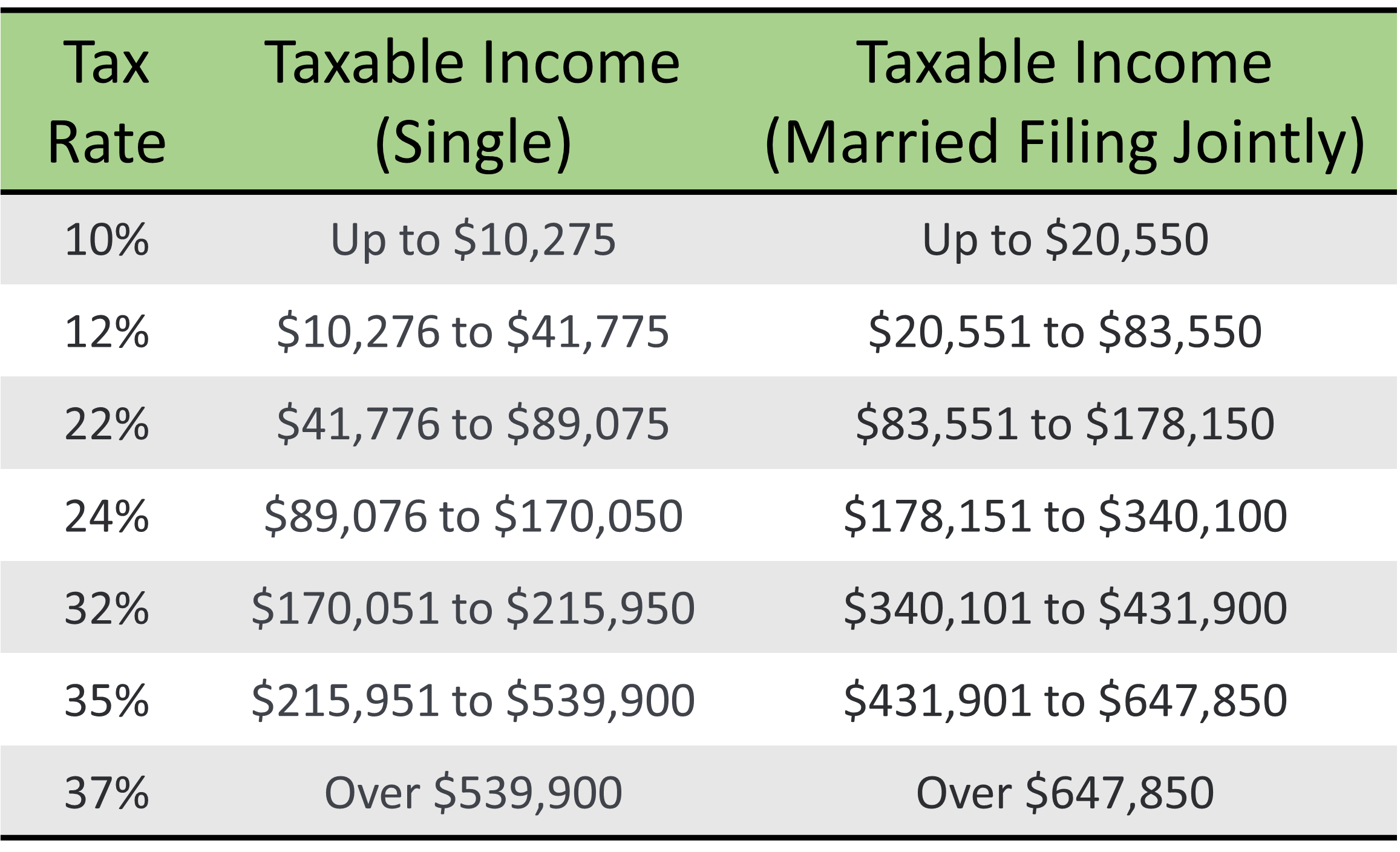

Here, we calculate how much we owe based off the Ordinary Income in our Taxable Income. Ordinary Income is any income taxed at the ordinary rate, called the Marginal Tax Rate. For the average working person, most of your income is considered Ordinary Income. This will generally include salaries, bank interest, commissions, rental income, and so on. This income will be taxed, in 2022, at the Marginal Tax Rate listed below;

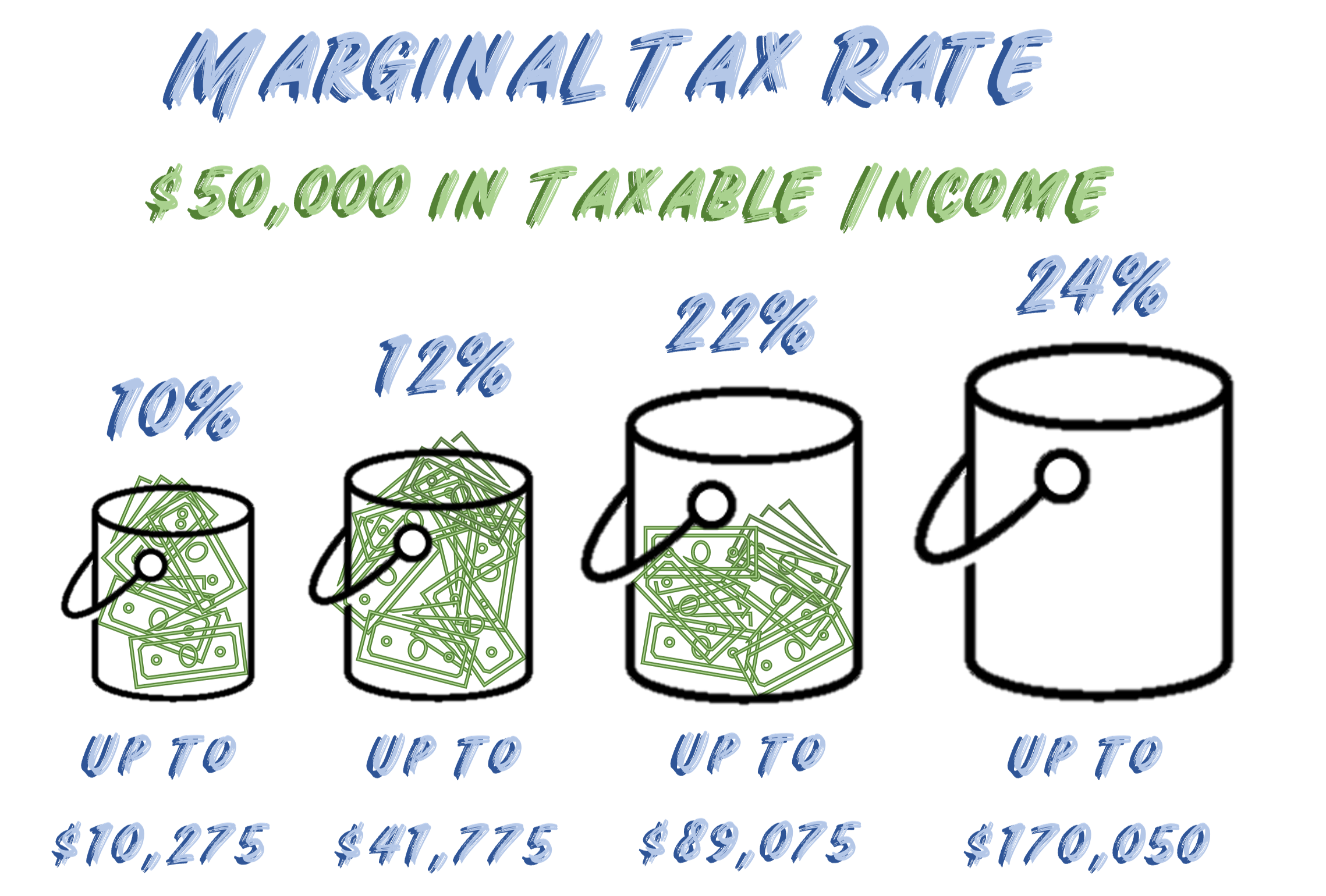

As you can see, the Marginal Tax Rate is based off your Taxable Income and personal situation. However looking at this, you might think that if you made $50,000 in Taxable Income, all your income would be taxed at 22%. That is not the case. The US Income Tax is a Progressive Tax, also called a Marginal Tax, meaning you only pay the percentage of that portion of your income. You can think of it like a series of sequential buckets.

So if you had $50,000 in taxable income, that income would fill up the first bucket, the second bucket, and part of the third. The money in each bucket is taxed Only at that rate. So for $50,000

Bucket 1) $10,275 x 10% = $1,027.50

Bucket 2) ($41,775 - $10,275) x 12% = $31,500 x 12% = $3,780

Bucket 3) ($50,000 - $41,775) x 22% = $8,225 x 22% = $1,801.76

Add that all up and you would owe, $1,027.50 + $3,780 + $1,801.76 = $6,609.26 in taxes.

Our Example: Looking back at our example, we discovered we have $39,550 in Taxable Income. Now, we’ll say the sold stock and half our dividends count as Capital Gains (we’ll explain that in the next part) so we won’t count that as Ordinary Income. Our new Ordinary Income is;

Taxable Ordinary Income = $39,550 - $1,000 - ($1,000 / 2) = $39,550 -$1,000 - $500 = $38,050

Now we use the buckets again, except this time we only fill the first and part of the second.

Bucket 1) $10,275 x 10% = $1,027.50

Bucket 2) ($38,050 - $10,275) x 12% = $27,775 x 12% = $3,333

Add it all up and we get $1,027.50 + $3,333 = $4,360.50 in Ordinary Taxes. This also gives us our Effective Tax Rate, or the percentage we actually pay in taxes. So, Marginal Tax Bracket is 12% in our example. However, your Effective Tax Rate is equal to your actual taxes, divided by Ordinary Taxable Income.

Ordinary Taxes Owed / Ordinary Taxable Income = Effective Tax Rate

So for our example, $4,360.50 / $38,050 = 11.46% Effective Tax Rate. In this case, not much lower than 12%, but you can see significant differences with higher incomes. But what about the Capital Gains?

3) Calculate Capital Gains Taxes Owed

Lastly, we have to calculate what we owe for Capital Gains Taxes. Capital Gains simply put is the increase in value of an asset from it’s initial purchase price. So if you bought a pair of collector sneakers for $200 and they are now worth $300 a year later, that’s a Capital Gain of $100. Now there are two types of Capital Gains; Short-Term and Long-Term. Generally, Short-Term Capital Gains are sold within a year or less and Long-Term Capital Gains are sold after a year. The important thing to know about this though is that Short-Term are taxed as Ordinary Income while Long-Term are taxed at a special Capital Gains Tax Rate. The Capital Gains Tax Rate is shown here below;

As you can plainly see, this is a much more favorable tax rate! So if you have a Stock Investment, hold for a year or more, and then sell for a positive return, it would be taxed at this rate. Of course, it’s taxed on top of your Ordinary Income. So, if you made $50,000 in Ordinary Taxable Income and made $5,000 in Capital Gains, the Capital Gains would be taxed at 15% because total income was over $41,675. Also taxed progressively, like Marginal Taxes.

We also mentioned dividends before as Ordinary Income. Well in our example, we also learned that half our dividends were taxed as Capital Gains. That’s because half our dividends were considered Qualified Dividends. Essential these are dividends that are taxed as Capital Gains. You can learn more about dividends at this link; Dividends Explained.

The Example Again: So we determined our Ordinary Taxable Income was $38,050. We owed $4,360.50 in taxes on that income. But what about the remaining $1,500 from our Qualified Dividends and sold Stock. These fall into the first Capital Gains Bucket!

Total Taxable Income = Ordinary Taxable Income + Capital Gains Income = $39,550

Capital Gains Tax = $1,500 x 0% since Total Taxable Income = $39,550

Therefore, the Capital Gains Taxed Owed is $0!

The Wrap-Up

I know this post had a lot of math in it, but I hope it was helpful. What I hope you take away is that;

Income Tax is collected for ANY Money make in the US

You may have different state taxes, although 8 states don’t have any income tax

You can reduce your Taxable Income through Adjustments and Deductions

Investing into certain Retirement, Life Insurance, and Health Savings Accounts (HSAs) can also reduce your Taxable Income

The Tax Bracket is MARGINAL! If you receive a raise, only the added money will be taxed at a higher bracket. Not ALL your income.

Capital Gains have More Favorable Rates than Ordinary Income

Now if that all interested you, stay tuned for when we release a post about how to (legally) Not Pay Any Income Taxes! For the time being, if you’re still unsure about how taxes work or if you’re doing it right, speaking with a tax professional or a certified financial planner is always the best idea. Either way, Financial Literacy is the Number 1 Key to Financial Success! Keep learning!

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.