Dividends Explained: Investing for Cash Flow

In the world of investing, there are plenty of different strategies and portfolio structures you can have to maximize your investment. You can be very risk adverse and invest heavily into bonds with low risk, blue chip stocks. Maybe you want to try and “YOLO” your money at Meme Stocks hoping to ride the high all the way to the Moon (this is a VERY Risky Strategy). In any strategy, one thing to consider for at least supplementing your portfolio is dividend stocks and how they may help your portfolio grow.

*DISCLOSURE ALERT* I own some of the stocks listed in this post. This is NOT an endorsement for any stock and they are being mentioned only as examples of dividend paying companies.

What are Dividends?

Dividends are disbursements of earnings or profits paid out by a public company to it’s shareholders. They are designed to be a reward incentive to investors for holding a stock. In other words, their purpose is to encourage you, the Investor, to invest in their company AND hold on to the stock (not sell it) for as long as possible. Normally when you invest in a company, you can only get capital out of your investment by selling your share. But with Dividends, simply holding the stock will earn you a payout of a portion of profits for “staying loyal.”

The amount of a dividend is different for every company. It’s generally determined by the board of directors and with a shareholder vote, although different business have different rules for dividend payouts (in the US at least) based off of Federal law. Although these funds could be distributed through additional stock issue, they are usually paid out in cash and are calculated as a percentage of the stock’s value, called the Dividend Yield. In other words, the dividend yield is equal to the annual payout divided by the current stock value.

Annual Dividend Payout / Stock Value = Dividend Yield

So, if a stock is valued at $100 a share, and pays $2 a year per share, then the stock would have a 2% Dividend Yield.

$2 / $100 = 0.02 = 2%

Now, the stock value of a company will fluctuate with the market and the dividend payout can change, so the Dividend Yield is not constant. In our a previous example, the value of the stock could drop to $80 a share with the same $2 payout, making the dividend yield now 2.5%. The same would be true if the value held at $100 a share but the shareholders voted to raise he payout to $2.50.

How often are Dividends Paid

Most of the time, companies will payout dividends on a quarterly basis, meaning roughly every three months. However, that’s not always the case. Some companies pay as rarely as once or twice a year while some others will payout monthly. When a dividend is paid out isn’t that important in most cases, unless you plan to live off dividends in retirement. If you do, you may want to buy dividends in a way where you’ll receive regular monthly payments. That will take some tracking though, and I recommend using the website Simply Safe Dividends. Now this site does cost about $500 a year, so don’t consider it unless you’re already making more than that from your dividends but it can help you track significantly going into the future.

Beyond the when the frequency of when a dividend will payout, there are some other important dates to know;

Announcement Date - This is the day the next proposed dividend amount is announced. It must then be approved by the shareholders.

The Ex-Dividend Date (A.K.A. Ex-Date) - This is probably the Most Important Dividend Date. The Ex-Date is the date when Dividend Eligibility Expires. If you buy the stock after this date, you aren’t entitled to the following dividend

For Example, the Ex-Date is September 19th. If you don’t by the Stock by September 16th (the previous business day), you won’t get paid the next dividend payment.

The Record Date - This is the date a company determine which shareholders are actually eligible to receive the next dividend. This doesn’t really effect individual investors very much. The Ex-Date is the key date.

Payment Date - In the immortal words of Jerry Maguire, “SHOW ME THE MONEY!!!” This is the lovely day we’ve been waiting for, the day the Dividend is Credited into our Accounts!

Common Types of Dividend Paying Stocks

Although any company can pay a dividend if the board and shareholders vote that they should, there are some companies who generally pay higher dividends and are more likely to pay than others. Some examples are;

Energy Sector Companies - Here, we’re talking about Oil, Gas, and Utilities Companies such as Enterprise Product Partners (Ticker: EPD) and Next Era Energy (Ticker: NEE). They tend to bring in high profits and generally have little room for growth. To incentivize investors, they tend to distribute dividends because the stock value tends to have slower growth than other sectors.

Healthcare Companies - These are your Pharma and Biotech Companies such as Johnson and Johnson (Ticker: JNJ).

Business Development Companies (BDC) - These are companies that Invest in other Small, Medium, and Distressed Companies such as Main Street Capital (Ticker: MAIN). These companies are special because they are considered Regulated Investment Companies (RIC). Because of this designation, they are required by law to pay Over 90% of their Profits to Shareholders. This helps the companies reduce their Corporate Income Taxes but means you make more money as an investor.

Real Estate Investment Trusts (REITs) - These are companies that either Own, Operate, or Finance Income Generating Real Estate such as Realty Income (Ticker: O) or Simon Property Group (Ticker: SPG). These companies are also required to pay at least 90% of Taxable Income to Shareholders. There are 3 main types of REITs;

Equity REITs - These Own or Operate revenue generating Properties

Mortgage REITs - These Lend Money to Property Owners through either Mortgages or by Acquiring Mortgage Backed Securities

Hybrid REITs - These are Companies that do both Equity and Mortgage

Now although these are some common, higher paying dividend companies, that doesn’t mean there are not other types of companies who pay dividends. There are even some Exchange Traded Funds (ETFs) that Pay Dividends such as Vanguards High Dividend Yield ETF (Ticker: VYM).

How are Dividends Taxed?

Dividends are generally depending on which of the type of dividend they are; Ordinary Dividends or Qualified Dividends.

Ordinary Dividends are your most common dividend and are taxed as Ordinary Income, so they would be taxed at the Marginal Tax Rate. That means they will be counted as additional regular income on top of your normal income and will be taxed at the rate in the table below for 2022.

So how much do you pay? Let’s assume you’re single, earning $50,000 a year at your 9-to-5 Day Job. You also own about 1,000 shares of a dividend paying company, let’s call it “Big Dividend Payer” or BDP for short. Those shares of BDP pay you $5 a year each, so $5,000 total. Since this is taxed on top of your regular income, it gets taxed at 22% as you can see in the table above. That means you pay 22% of $5,000 or $1,100 in taxes. In other words;

Ordinary Dividend Income = 1,000 x $5/year = $5,000

Dividend Income x Highest Marginal Tax Rate = Taxes Owed

$5,000 x 22% = $1,100 in Taxes Owed

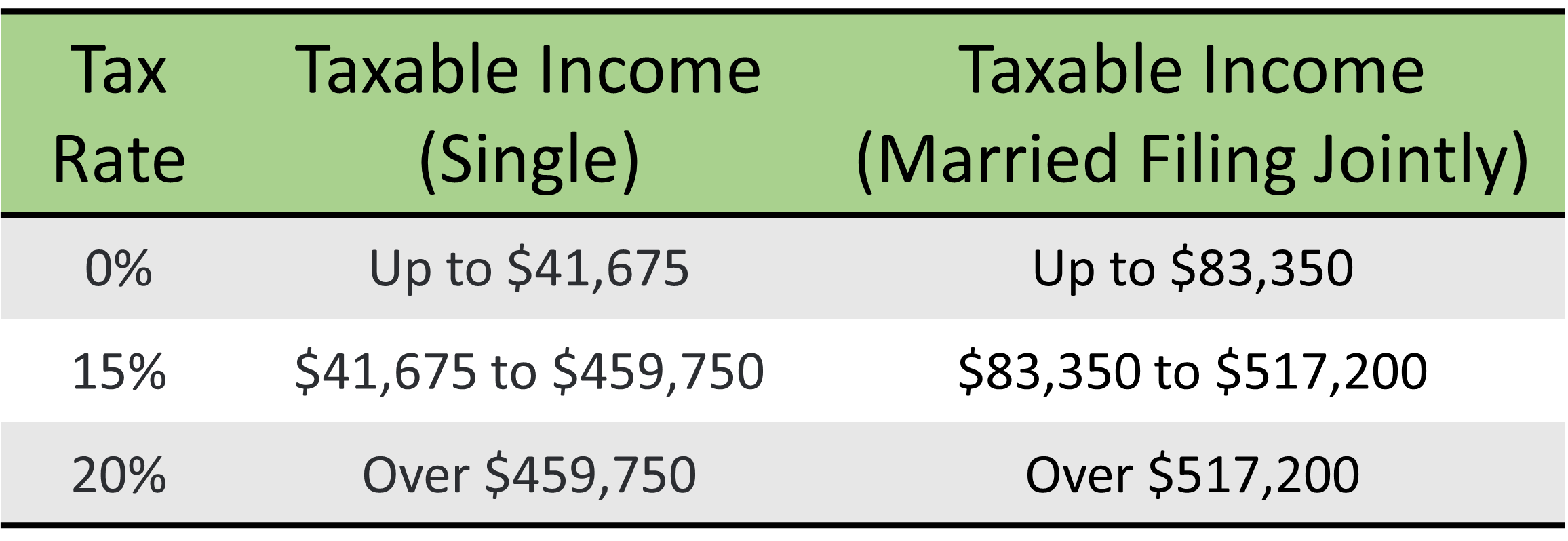

Now Qualified Dividends are special because, unlike Ordinary Dividends, they are taxed as Capital Gains and therefore, at the Capital Gains Tax Rate. So although this is also taxed on top of your regular income, you would pay taxes at the rate of this much nicer table below.

So with our previous example, if our BDP shares are considered Qualified Dividends, they would be taxed at only 15% instead of 22%. That means we would only owe $750 instead of $1,100! Better, right?

Qualified Dividend Income = 1,000 x $5/year = $5,000

Dividend Income x Highest Capital Gains Tax Rate = Taxes Owed

$5,000 x 15% = $750 in Taxes Owed

So if all your income came from Qualified Dividends, and you made less than $41,675 a year if you’re single or $83,350 a year for a married couple, you Wouldn’t Owe Any Taxes!

Of course, there are some requirements for a dividend to be considered Qualified and Taxed as Capital Gains. The rules for the company are;

Dividend Paid by a US Company

Dividend Paid by a Company in US Possession

Dividend Paid by Foreign Company residing in a Country Eligible for Benefits

A Foreign Company’s Stock that is Easily Traded on Major US Markets

Of course, this doesn’t mean you will also get the Capital Gains benefit. In order to get that, you must;

Hold the Ordinary Stock in Excess of 60 days during the 121 Days from 60 days before the Ex-Date

Hold Preferred Stocks in Excess of 90 days during 181 Days from 90 days before the Ex-Date

Also, All Real Estate Investment Trust and Business Development Company Dividends are Taxed as Ordinary Income. So you won’t get the benefit of Qualified Dividends for those stocks.

Should you Invest in Dividend Paying Stocks?

Sorry for another unclear answer, but whether you should Invest in dividend paying stocks really Depends on your Investing Strategy and Personal Financial Situation.

For example, one reason you may NOT want to invest in dividend paying stocks would be you already earn a High Income or pay Heavy Taxes. Even if you’re invested in Qualified Dividends, you’ll be incurring an added tax bill from your dividends. With stocks that don’t pay dividends, you only owe taxes on those investments when you sell. With dividends, you pay extra in taxes every year.

However, if you’re like me and prefer to Increase your Annual Cash Flow, dividend stocks may be a Good Idea. I personally don’t mind paying more in taxes in order to earn more Passive Income now. This means I can make more money today without having to put in more physical time so I can hopefully reach my F.I.R.E. Number and maybe even retire early. If you decide you want to invest in Dividend stocks, you can Start Investing Now with the links at the end of this Post.

Of course, everyone’s financial situation is different, do speaking with a licensed and certified Financial Planner is always a good idea. Even if you don’t, remember that Financial Literacy is the Number 1 Key to Financial Success! Keep learning!

Links

If you’re interested in opening an IRA with E*Trade, click this link (→E*Trade←) and you will get rewarded with up to $3,500 once you open an account and make a qualifying deposit! Reward amount depends on how much you deposit.

If you’re interested in opening an IRA with WeBull, click this link (→WeBull←) and you can earn up to 5 free stocks when you open and fund your account!

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.

*Affiliate Disclosure* This post contains an affiliate link. By clicking on the link and utilizing the service, LiveItAwesome LLC and/or the posts author may receive some form of compensation from the linked Affiliate.