The “Rule of 72” and How it Works

If you’ve been reading this blog for a while, you might be starting to think, “Wow! Seems like a lot of rules for finances…” and you’re not wrong. We do have a lot of “Rules”, but these rules aren’t hard set rules that if you don’t follow them, you’ll be financially bankrupt. To quote Captain Barbosa from The Pirates of the Caribbean, “is more what you’d call ‘guidelines’ than actual rules.” These rules are more about giving yourself tools and guidelines to help you make your own rules and the “Rule of 72” is no exception. If you’ve researched FIRE before, may have heard this term but never truly understood what it means or it’s value to you, so we’re here to help. Let’s get into it!

What is the “Rule of 72”?

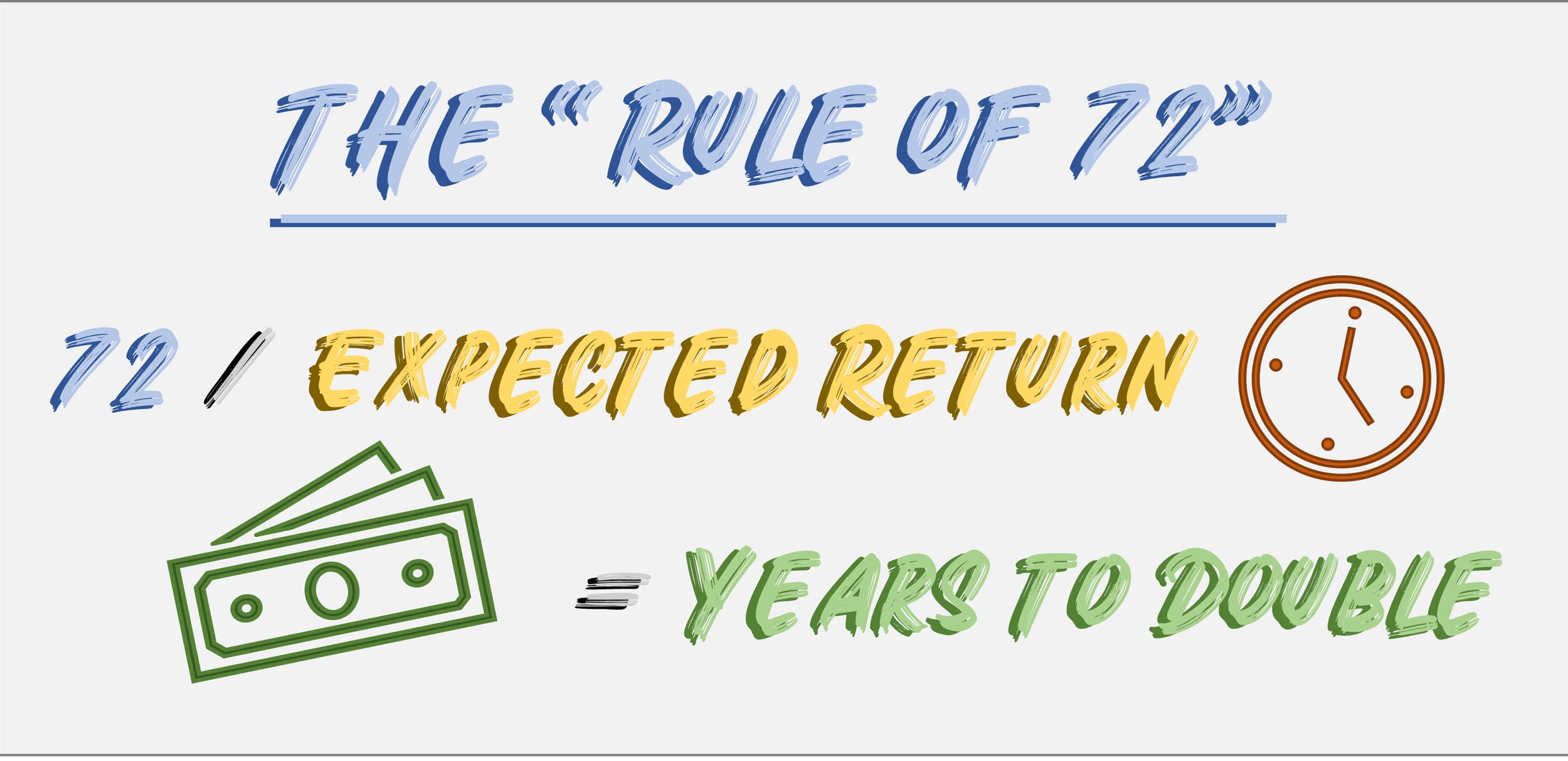

The “Rule of 72” is actually a formula which can let you know either how long in years an investment will take to double at a specific rate or what rate of return you need for an investment to double over a specific timeframe. Essentially, if you know either an expected rate of return or a timeframe you hope your investment to double in, you can solve for the other value. The way it works is you divide the value you know from 72 and that will leave you with the answer you’re looking for. Here’s how that looks “all mathed out”;

72 / Expected Rate of Return = Time to Double

(OR)

72 / Time to Double = Rate of Return Needed

It’s worth noting that this formula won’t be perfectly exact because it’s a simplified version of a much longer equation. There are much more specific formulas out there that can give you the exact amount of time until your investments reach certain values, spreadsheets with full breakdowns, and so on, but this is a great place to start.

How does the “Rule of 72” Work?

The best way to explain how it works is with an example. Let’s say our good friend Taylor has $10,000 and they’re curious when that amount will double. Let’s also say the find a really amazing High Yield Savings Account that’s offering a 4% compounded interest rate. If you divide 72 by 4, that will give you a rough approximation of when they’re money will double.

72 / Expected Rate of Return = Time to Double

72 / 4% = 18 Years

So, if Taylor has a 4% Compounding Interest Account, they’ll double their money in 18 years. So in 18 years, that $10,000 will become $20,000. Also, in 36 years at 4%, that will grow to $40,000, $80,000 in 54 years, and so on. It’s also worth noting two things from this equation;

1) Percentages are used in this equation as whole values. So from our example, 4% is used as 4 in the equation and not 0.04.

2) This equation only works with Compound Interest, meaning that the interest is continuously added to the principal value and included when assessing for more interest later. For Simple Interest, or accounts where the interest doesn’t add to the value of the principal or is removed before it can be added for future interest payments, this equation won’t be helpful.

So let’s go back to our example. We’ll assume that Taylor realizes they’ll need the money to double in 10 years or less because they’re planning to buy a house in that timeframe and need a bigger down payment. Now you want to what rate of return they’ll need to make that happen. So now divide 72 by 10 to get that required return.

72 / Time to Double = Rate of Return Needed

72 / 10 Years = 7.2%

From the equation, we find out that Taylor would need to try and find a source producing a roughly 7.2% rate of compounding return, like maybe an S&P 500 ETF. *Quick Disclosure* Historical returns do not guarantee future returns and you may not see those kinds of returns repetitively over the 10 years you’re hoping to double your money, but we’ll assume it does for this estimated guess. So in our example, if Taylor needs the money to double faster, they might need to go for a higher return, although it may mean a riskier investment and vice versa.

Last not to make about this equation is that it works best with interest rates that are between 6% and 10%. IF you have a rate outside this range and want to find a closer approximation, you can add or subtract 1 from 72 for every 3% above or below 8%. So if you had an interest rate of 5%, since that 3% less than 8%, you would subtract 1 from 72 getting 71 to divide from. That all being said, the “Rule of 72” will give you a close enough approximation for most simple financial decisions.

How can the “Rule of 72” Help You?

Of course this rule has many applications and reasons that you would want to use it. However, there are 3 Main Ways I use this rule to help me with different challenges everyday.

1) Financial Goal Planning

The “Rule of 72” is ideal for doing some quick goal planning because you can quickly figure out how long it will take for you to double your money or what kind of return you need for your timeframe. Looking at our example, Taylor is doing exactly that. If Taylor needs their money to double in a specific number of years, they can use the “Rule of 72” to figure out what kind of return they need. If Taylor is just trying to figure out how long until they think they can retire, using the rule and knowing what their current return on their savings can help them figure out how much long they should expect to keep working. As we said before, there are more precise methods to hammer out exact answers, but this rule give you an easy way to figure out some plans early on.

2) Determine and Investment’s or an Item’s Value

This on is kind of twofold. The first being determining an Investment’s value. With the “Rule of 72”, I can quickly determine how much money I should hope to have from what I expect an investment’s rate of return to generate. So if I have $1,000 to invest and the historical annual return of that investment is 10%, the “Rule of 72” tells me it will double in a little over 7 years. Now I can determine if those 7 year long return means this investment will meet my goals knowing the level of risk it also has. Depending on where I am financially, doubling my $1,000 in 7 years will always sound great, but if I need on $1,200 in the next few years, and this investment is risky enough I know I could loose that, I may opt for a lower return and lower risk investment so I can better protect what I have.

I use a similar method with determining an Item’s Value. Assuming after inflation the S&P 500 returns roughly 7% per year, I know (thanks to the “Rule of 72”) that I could expect to double an investment in 10 years. So before I buy something, I will ask myself, “would I rather have this item now or double it’s value in 10 years?” If I answer with the item now, assuming it meets my other criteria for buying things that you can read about at this link, I’ll buy it. However, if my answer is double the money in 10 years, I know I don’t really want the item and won’t buy it.

3) To Explain the Value or Compound Interest

Finally, this is how I use the “Rule of 72” to explain the importance of Compound Interest. The “Rule of 72” uses math that almost anyone over the age of 9 should be able to understand. Being able to quickly show how fast money can double with compound interest has helped me to excite people new to investing and saving towards reaching their financial goals. This has helped encourage others towards better financial decisions and, in some cases, even seek further Financial Literacy. Now, this may not be something that concerns you, but I honestly believe sharing knowledge about personal finance will help raise everyone’s financial literacy and can help people reach higher goals in even other aspects of life. As I always say, Financial Literacy is the Number 1 Key to Financial Success!

So share what you know! An easy way to do that is by sharing this site! It helps us grow and also can help spread the value of Financial Literacy to a wider audience, so please share! Thank you so much for reading!