Avalanche vs Snowball Debt Repayment Methods: The Good, The Bad, and The Side-by-Side

Debt… The Destroyer of Financial Stability. High Interest debt especially can erode ones ability to save for retirement, plan for emergencies, or even get so bad they can’t pay their bills. Getting rid of that high interest debt is key to developing financial stability. Two main methods experts talk about for this are the Avalanche Method and Snowball Method. Today, we’ll define them and then compare the two so you can decide which is best for you, if you find yourself in High Interest Debt and want to take steps before consolidating your debt.

The Avalanche Method

What is the Avalanche Method?

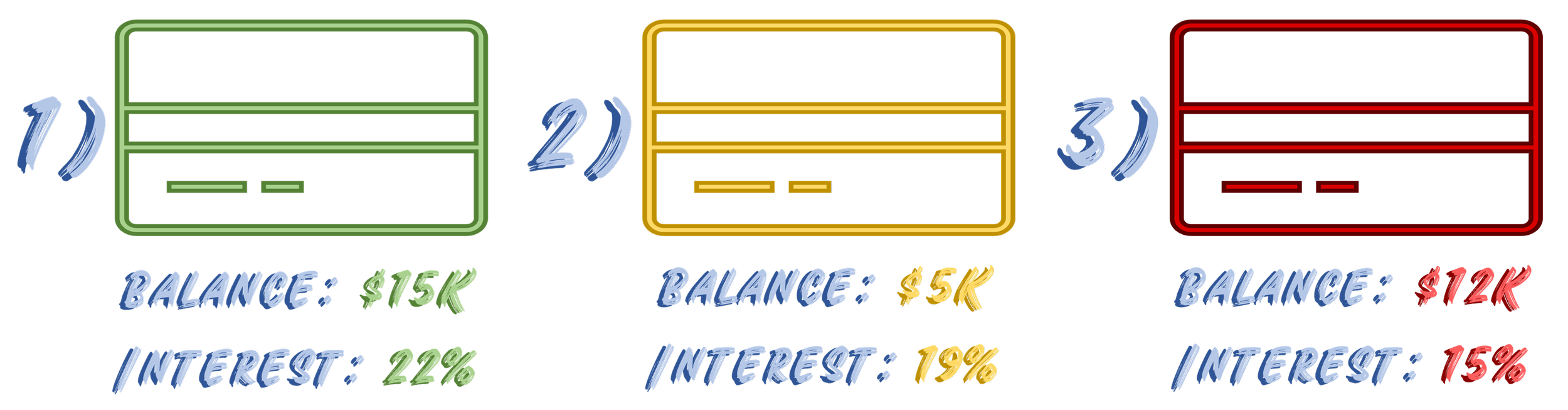

The Avalanche Debt Method is the method where you have to prioritize paying off the Highest Interest Rate Debt First. So, you start by listing out all your debt with balances and interest rates, then you organize them by interest rate, make all the minimum payments first, and then any extra funds in your budget goes towards the highest interest rate account. So, let’s say you list out your debt and have 3 credit cards with outstanding balances as below. You would pay them off in the order listed:

So, once the first (green) credit card balance is completely paid off, you move to the next highest interest, and so on and so on. Just be sure you continue to make all minimum payments. Defaulting on a card would defeat the purpose of trying to pay off the debt.

The Good

The best advantage to the Avalanche method is you save more on interest payments. By reducing the highest interest account first, the rates won’t increase funds as quickly as the highest interest account would. This also allows you to get out of debt faster because you have to pay less in interest. It also creates a solid payment structure to follow. If you’re used to tracking your spending and budget your extra money, this gives you a great path to follow for how to get out of debt quickly.

The Bad

Since this method is interest rate oriented, it can take more discipline than other methods because you really need to know the rates you’re being charged. For example, some credit cards have variable rates. You may start at an introductory 0% interest rate, but after 6 months or a year, that card may jump to 24% and be your new highest interest rate. Also, since your highest interest rate could have the highest balance, this method could take longer to pay off individual accounts. Like in our example, because you may not have a lot of extra funds to reduce debt, it could take a long time to pay off the Green Card. The Yellow Card with the smaller account could be paid off more quickly. This effect can decrease your motivation because you may start to feel like you’ll never pay off that large account. It also requires you to have extra funds in your budget to focus down on one account which wouldn’t be a factor if you were able to consolidate your debt.

The Side-by-Side

The Good

Save More on Interest

Get out of Debt Faster

Solid Rules to Pay off Debt

The Bad

Takes More Disciple and Knowledge

Longer time with Multiple Debt Accounts

Could Decrease Motivation

Requires Extra Funds

The Snowball Method

What is the Snowball Method?

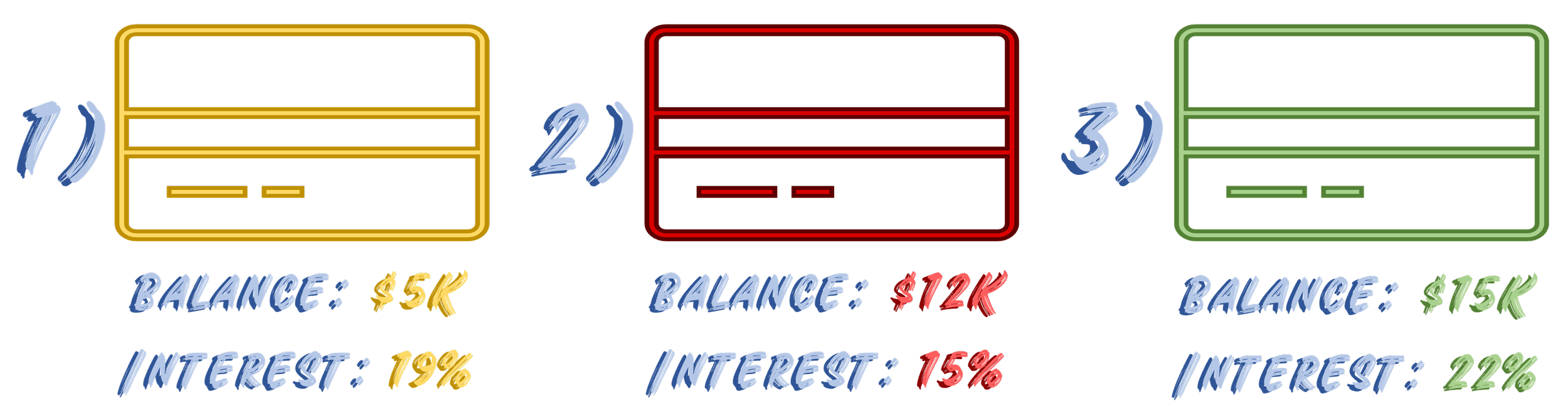

The Snowball Debt Method is a simpler method because it prioritizes paying off the Lowest Balance Debt First, regardless of interest rates. So, you’ll start the same way by listing all your debts with the balance and you make the minimum payments, but now you focus on the lowest account balance first. And if we use the same example, this is the new order you would pay off your 3 credit cards in;

Now, once the lowest balance is paid off, you focus in on your next lowest balance to start knocking those accounts out. I do again want to stress, make all minimum payments on your accounts. This is the minimum requirement to get out of debt.

The Good

The best advantage to this method is close debt accounts quickly. If you have many different debts, by knocking out the smallest ones first, you can close your accounts more quickly. Also, since the feeling of closing out a whole debt account quickly feels so good, this method is considered to build motivation quickly. It is also a very simple payment method. You don’t need to really understand how your interest rates work or even know what they are. Just pick the one with the lowest money and pay it off. Therefore, it requires less knowledge or discipline to be successful.

The Bad

The biggest disadvantage to the Snowball Method is you will pay more in interest over time. It’ll end up costing you more long term because the higher interest rates have more time to grow. This also means it will take longer to get out of debt because you’ll end up paying more. The more the balances grow, the less effect your extra funds will have to pay down the accounts. This method will also require you to have extra funds in your budget to pay down those debts.

The Side-by-Side

The Good

Close Debt Accounts More Quickly

Builds Motivation Quickly

Very Simple Repayment Method

Requires little Knowledge or Discipline

The Bad

Pay More in Interest Long term

Longer time to Get Completely out of Debt

Requires Extra Funds

The Final Side-by-Side

In the Final Side-by-Side, we will compare what we discussed (in this case the Avalanche and Snowball Debt Methods), side-by-side. If I would consider the listed effect to have a neutral impact or both items have the same feature, the text will be Black. If it’s something one method offers that is better than the other, the feature will be written in Green. Lastly, if the feature is worse than what the other offers, it will be written in Red. So, let's compare!

The Avalanche Method

Save More on Interest

Get Completely Out of Debt Faster

Solid Rule for Paying off Debt

Takes More Discipline and Knowledge

Longer time with Multiple Accounts

Could Decrease Motivation

Requires Extra Funds in Budget

The Snowball Method

Pay More in Interest

Takes Longer to get Completely out of Debt

Simple Rule for Paying off Debt

Requires Less Discipline and Knowledge

Close Debt Accounts More Quickly

Builds Motivation Quickly

Requires Extra Funds in Budget

Now, as we look at these difference side-by-side, we notice that the benefits of the Avalanche Method are more Tangible, meaning they are more mathematical or measurable, while the benefits of the Snowball Method are more Emotional, focusing on how you feel about getting out of debt and making it easier. Either method, the biggest concern is doing your best to get out of debt. Choose which method would get you through paying off your debt the best. Everyone is different.

We also notice in both that they Require Extra Funds in our Budget. The only way to avoid that would be to Consolidate Debt, or restructure all the debt under one loan or credit card. In that case, you may be able to set all your accounts into one and only require one payment to focus on. That is another option you can also consider. As I mentioned before, everyone’s situation is different so I always recommend speaking with a financial planner to determine what route is best for you. Of course, Financial Literacy is the number one factor in Financial Success, so keep learning!

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.