What is a “Recession” and How do we Thrive in It?

At a recent congressional hearing, Federal Reserve Chair, Jerome Powell, finally acknowledged that the steps being taken to curb inflation may lead us into a recession. The big, scary “R” word… Even Cardi B has been tweeting about it. But what actually is a Recession? How much does it affect the average person? And what steps should we take to get through one? Let’s dive in!

What is a Recession?

A Recession is any sustained period of weak or negative Gross Domestic Product (GDP), the total value of goods and services produced by a single country. A recession is generally accompanied by a rise in unemployment, falling retail sales, and other income factors. Generally speaking, we have typically considered ourselves in a recession when we’ve seen two consecutive quarters of declining GDP, as measured by the US Bureau of Economic Analysis (BEA). However, the BEA does not officially decide when we’ve entered a recession. The official determination of a recession is made by a committee of experts within the National Bureau of Economic Research (NBER), private, non-profit organization that conducts research into the US Economy.

When do we learn if we’re in a Recession?

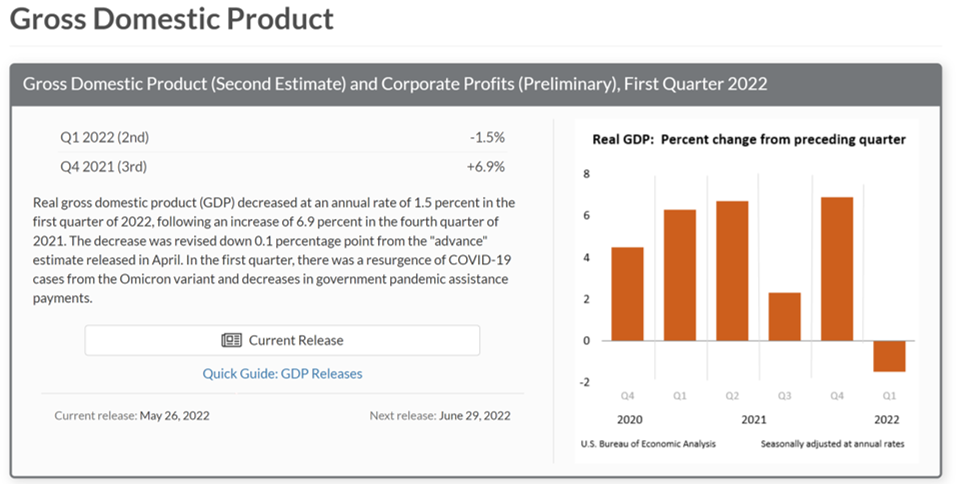

From US. Bureau of Economic Analysis (BEA)

Using the general determination above, two consecutive quarters of declining GPD signals a Recession. In the first quarter (Q1) of 2022, the BEA reported a real GDP decrease in the annual rate of 1.5%. Q4 of 2021 was positive, so we would consider ourselves in a Recession if we have a negative Q2. The BEA is expected to release the Advanced Estimate for Second Quarter GDP on July 28th at 8:30AM. If the Q2 reports and increase in GDP, we’ve dodged the “Recession Bullet” but if it continues to be weak or negative, we could find ourselves in the face of a Recession.

On the other hand, we have not seen a rise in Unemployment, with unemployment currently holding at 3.6% for May 2022, according to the US Bureau of Labor Statistics (BLS). This bodes well for the chances of us avoiding a recession, but there is no guarantee that it will prevent one from occurring.

What is the Impact of a Recession?

First, we tend to see Bear Stock Market Indexes, or a 20% decrease in stock value since the most recent high. Of the 25 S&P 500 bear markets, 14 have prefaced a recession and those bear markets were historically worse. Studies have shown that, on average, the S&P 500 will lose about 32% of it’s value during a recession. So, likely your retirement and individual portfolios will take a hit.

After that, probably the biggest and most impactful result from a Recession is significant job losses. During the 2008 recession, nearly 9 million people were laid off and there were about 22 million in 2020. There also tends to be a decrease in hiring, meaning those that lost their jobs tend to have trouble finding new work. Even the individuals who were lucky enough to keep work tend to see a decrease in hours, lack of promotion, or even reduction in pay. This loss of income also generally leads to other effects including prolonging higher education, putting off having children, and delaying major purchases such as a home or car.

Now, there are some positive impacts, such as we usually see a decrease in inflation. This is really why the Federal Reserve would allow such a thing to occur, so that we can bring the price of things back down to a more normal level. Even though, in the short term, it will certainly hurt.

How can we Prepare for a Recession?

Although there are many actions you can take to prevent recession effects, we’re going to discuss 5 specific steps you can start right now to reduce the impact to you.

1) Keep a Steady Income

Sorry to say this but if you were planning on retiring soon, you might want to hold off a little while longer. With the still high inflation and significant stock market decreases, it would make sense to maintain you’re regular income from your current primary source as best you can. This is true even if you weren’t planning on retiring. With the expectation that layoffs will increase, a significant number of individuals will lose there jobs, and hiring freezes will be put into effect in a recession, now is the time to make yourself indispensable at your current job. Doing what you can to ensure that your primary, regular income will keep flowing is critical as the market tanks.

2) Increase your Emergency Fund

The average bear market lasts around 9 and 1/2 months while the average recession has lasted about 15 months. If you end up part of the unfortunate who are laid off during such trying times, you need to be prepared for the possibility of significant time with no regular income. Generally, experts recommend 3 to 6 months worth of expenses to be saved for an Emergency Fund. With how long recessions can last, it may be worth increasing your savings to prepare for a longer period with no regular income. Just be sure those savings are liquid, meaning the funds are being saved somewhere you can access it immediately with no penalty, such as a high yield savings account.

3) Pay down High Interest Debt

Now, if you’ve set yourself up to keep that regular income and you’re comfortable with your Emergency Fund, NOW is the time to pay down that debt. High interest debt can significantly impact your monthly expenses. If you’re constantly paying only the minimum on a credit card, the revolving interest will keep growing before you can pay it down. Then, if you lose that regular income and can’t make the minimum anymore, you could default on those payments, get sent to collections, and drastically decrease your credit score. While you have the regular income now, you can pay down those debts to reduce your monthly expenses if the worst happens. Of course, not all debts apply such as mortgage. Reasons why you should wait to pay down your mortgage can be found here.

4) Buy the Dip

Although the phrase “Buy the Dip” generally is used for timing the markets which is typically not a good idea, what I mean here is you want to keep buying even while the stock values fall. It may seem counterintuitive, but a lot of money can be made during bear markets. As the value falls, you can essentially buy stocks at a discount. Recessions are not forever. At a some point, we expect the market will recover as has historically been the case. However, past performance does not guarantee future performance and smaller companies may not be able to survive the turbulent times, an educated guess can predict well established companies should succeed. As the American Economist, Benjamin Graham, once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” The companies that are balanced well should weigh out well in the long run. So even as the market falls, those with time for the market to recover can continue to invest for better returns. This is commonly referred to as Dollar Cost Averaging, or investing fixed, regular amounts regardless of the stock price.

5) Start a Side Gig

Many companies have been built during recessions, to include Microsoft, Uber, and Airbnb. If you see your income falling, this could be a good time to find ways to supplement it. Now I’m not necessarily saying you need to go start a business, but earning extra income could be key during trying times. Diversifying your income protects you if one begins to fall short. Think of an object being balanced on a column. If there is only one column and that column breaks, the object will certainly fall. Now, if you can add more columns to support the object, even if one column breaks, you can now rely on the other columns to help support it.

The Wrap-Up

The Big “R” word can certainly be a scary thing. There are generally a lot of not-so-great impacts that tend to hurt the average person. But understanding those impacts can help us prepare so we aren’t as affected. What we should remember is;

A Recession is typically marked by a sustained Decrease in GDP with Increasing Unemployment

The Impacts tend to include a Decreasing Stock Market, Significant Job Loss, and further cascading affects

We can alleviate those impacts by preparing in 5 ways;

Making yourself indispensable can help protect your main Income Source

“Plusing up” your Emergency Fund can provide a better cushion for Lean Times

Reducing Monthly Expenses, especially High Interest Debt, can make things easier if the worst happens

Continuing to Dollar Cost Average can let you buy at a discount

Generating New Sources of Income help protect your Lifestyle if one source stops

Even during a Recession, we can still make significant money and protect ourselves for the future. Most of all, we need to keep learning. Financial Literacy is the Number 1 Key to Financial Success!

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.