The 50/30/20 Rule Explained: Will it Work for You?

Trying to establish a budget can be hard. Just like a diet, there’s a bunch of advice out there on how to save more, make more money, and where to cut back. Finding a simple rule to ensure you will be fine in retirement may seem confusing, but this Rule actually does make it easy. The 50/30/20 Rule is designed to do just that by offering everyone a simple guideline to follow to reach retirement. But what is it and will it work for you?

What is the 50/30/20 Rule?

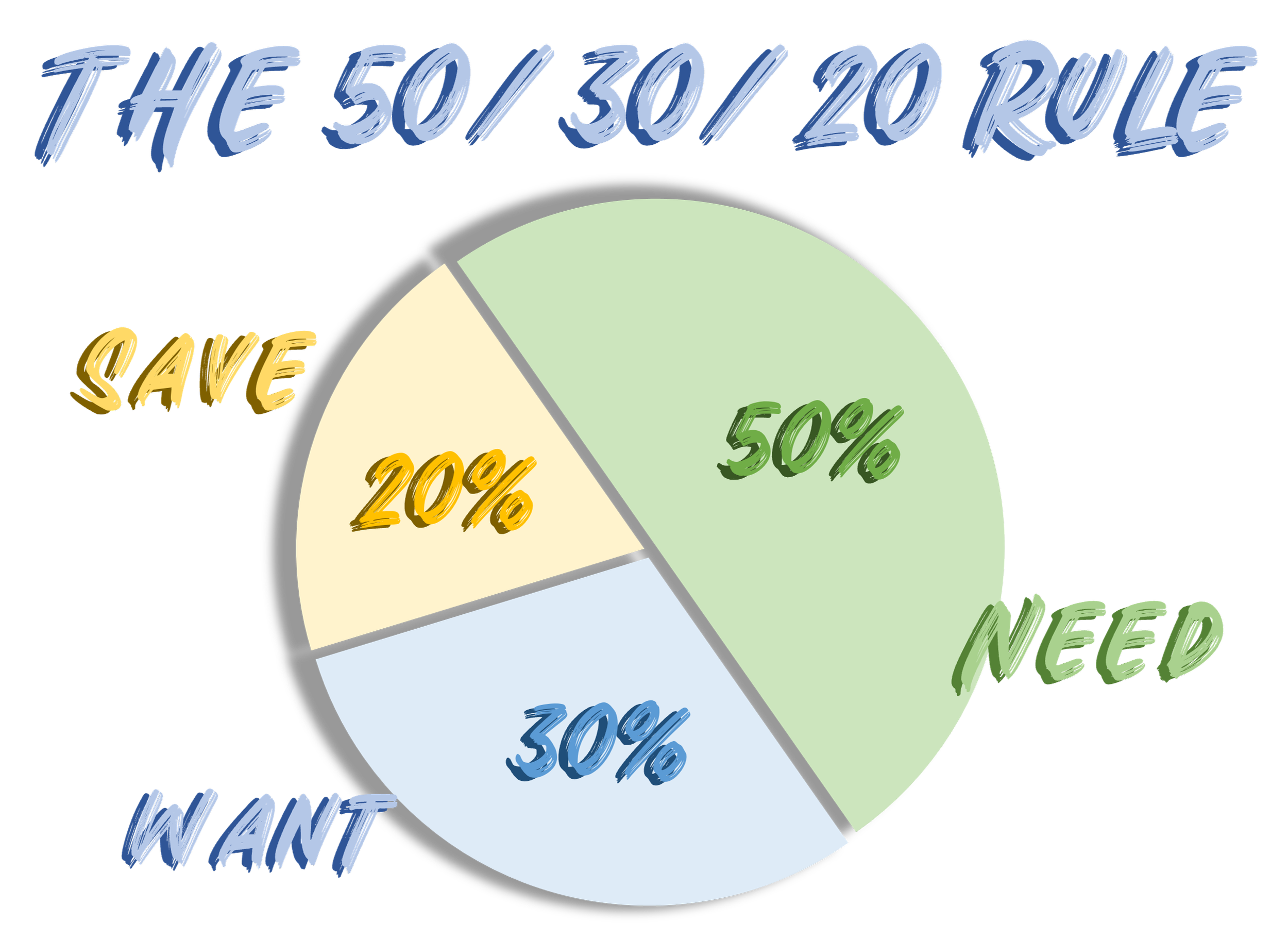

First mentioned by Elizabeth Warren, current US Senator and former Special Advisor to the Secretary of the Treasury, and her daughter in their book, “All Your Worth: The Ultimate Lifetime Money Plan”, the 50/30/20 Rule set out a simple principle for saving for retirement. The rule is, you take your after-tax income and spend 50% of that income on Needs, 30% on Wants, and 20% goes to Savings and/or Debt Repayment. Simple, easy, and straight forward.

How to Use the 50/30/20 Rule

Breaking it down into the categories of Needs, Want, and Savings, let’s look at how the Rule works for you. Before you get started though, you’ll need to first determine your after-tax income. If you’re a regular salary worker, this will be easy to do; just review your regular paycheck. However, for gig workers, entrepreneurs, or hourly workers, this can be more challenging. You can either use your previous years tax return to get an idea for your after tax income or you can take an average of your monthly income for the last few months. Either way, you’ll need to track your income, spending, and saving in order to ensure you are sticking to the rule.

50% for Needs

Let’s start with 50% of Income towards Needs. Half of the money you make can be used for spending on the items you need. These are the essentials you need to live and can’t be avoided. First, you will need to characterize these items by asking yourself, “Is this purchase necessary for the health and safety of myself or my family?”

Some examples are;

Rent or Mortgage Payments (Housing)

Utilities (Electric, Water, Gas, etc)

Transportation

Essential Groceries

Insurance (Health, Vehicle, Property)

Now, not all needs will be obvious in the same way. One I want to stress is making All Minimum Debt Payments is a Need. This may seem confusing since we listed Debt Repayment with Savings, but that is referring to paying more than the minimum. If you aren’t making at least the minimum payments, you will owe significantly more in interest, you’ll damage your credit score, and could eventually be taken to collections which will hurt the financial safety of yourself and your family. I’ll say it again, Minimum Debt Payment is a NEED!

Now that we’ve characterized what purchases fall under Needs, now we need to see how much we spend on them to make sure it’s within the 50/30/20 rule. Under the rule, you’re allowed 50% for Needs or Half of your After-Tax Income. This is easy to calculate. Just take your after-tax income and divide by 2.

After-Tax Income / 2 = Available Needs Expense

So if say you make $5,000 a month after taxes, then you’re allowed $2,500 a month for your Needs. Now when you add up all your Needs Expenses, if it’s at or under that $2,500 a month, you’re all set. If not, you’ll have to find ways of cutting back by either buying cheaper grocery options, finding cheaper housing, or cheaper transportation if it’s available to you. Either way, tracking your spending is essential to maintain the rule.

30% for Wants

So we’ve got your Needs at 50% of your after-tax income, let’s delegate 30% of the remaining income for Wants. These are easier to define. Simply put, Wants are any purchases that Don’t qualify as a Need. These are those Non-Essential shopping trips and splurges that aren’t required for you to survive.

Some examples are;

Meals at Restaurants or Bars

Expensive Clothing

The Newest iPhone or TV

Happy Hour Drinks

Streaming Subscriptions

Vacations

Like I said above, if it doesn’t qualify as a Need, then it would be a Want. If you ask yourself the question, “Can I or my family live without this?” and the answer is Yes, you would label it a Want.

We’ve laid out our Wants, so let’s move onto the math. You can a lot up 30% for Wants, so you would multiply After-Tax Income by 0.3.

After-Tax Income x 0.3 = Available Wants Expense

So if we reuse our example of $5,000 a month, you’ll multiply that by 0.3 and get $1,500 for Wants. Again, if we add up all our Wants and it’s at or under that amount, you’re doing great! However, if you’re over that 30% number, you’ll need to cutback. Now, these items are a lot easier to cut back on because you don’t need them, but it’s a lot less fun. If you’re prone to making emotional purchases as well, you’ll want to use some other strategies, like the 72 Hour Rule and “Regret Checks” to help prevent some of that overspending.

Now, how you differentiate between Needs and Wants will be different from person to person. For example, you may not consider a Gym Membership a Need, but your friend “Gym Rat Taylor” lives at the gym and personally requires it for their sanity. That’s okay! This rule will help you become more conscious of your spending, but you want to avoid getting hung up defining Needs and Wants. If there is something you technically could live without, like the gym, but it would significantly diminish your mental health without it, you should call it a Need. You can still enjoy your life and how you define purchases are subjective. What’s Most Important is Keeping Spending Under 80% of your Income. If you can at least do that, you’ll be alright. Even if you call your Netflix Subscription a Need…

Save 20% of your Income

Now we’ve got our Needs and Wants under control and we can put the rest of our Income to work in Savings. The goal is to Save 20% of our After-Tax Income. We would also use this money to Pay Down our Debts. So any outstanding debt you may have, such as student loans, you can use this 20% to pay that down. There are two main ways to pay down debt; The Avalanche Method and The Snowball Method. Again, don’t use this money to just make the minimum payments. Minimum Debt Repayment is a NEED.

Now, 20% of your income would be After-Tax Income multiplied by 0.2. If this were our $5,000 a month example, you need to save $1,000 a month.

After-Tax Income x 0.2 = Goal Savings

With this money, we’ll want to give it a job to work for you. Generally, you’ll want to have your money work in this order;

Set Aside an Emergency Fund - Should be at least 3 to 6 months worth of your expenses OR 6 times the cost of your monthly Needs

6 x Available Needs Expense = Emergency Fund Value

Pay Down High Interest Debt - Any Loans with Interest Over 4%

Invest in a Tax Advantaged Account - Invest in an Employer Sponsored 401(k) or Roth IRA or Similar Accounts

Invest in an Individual Brokerage Account - Do this Only AFTER Maxing out your Tax Advantaged Account

There are of course many other methods and strategies for how to save your 20% and everyone’s situation will be different, but this is generally the recommended route for most people.

How does the 50/30/20 Rule Work?

Knowing how to use the 50/30/20 rule is one thing, but understanding how the 50/30/20 Rule works and why you may want to use it is another. This comes back to another concept we’ve discussed before in a post about the F.I.R.E. Movement, and the concept is called the 4% Rule. The way the 4% Rule works is that, as long as you only withdraw 4% or less from your Investment Portfolio for your expenses, you could live off that portfolio forever. This was determined by a financial advisor in the mid 1990s but the math still holds true today.

So if you were to use the 50/30/20 Rule, you would Spend 80% of your Income and Save 20%. Then, let’s assume you spend the same amount in retirement as you spent while working. After just over 30 years of investing with an assumed 7% annual return, you would have enough saved in retirement to live off the 4% Rule. Let’s break it down with our example of making $5,000 a month.

Spend $4,000 a month ($2,500 for Needs + $1,500 for Wants)

Save $1,000 a month, Continue for 31 years

$1,000 a month for 31 years at a 7% Return equals $1,263,694.58 (you can do your own calculation with this Investment Calculator)

4% of $1,263,694.58 is $50,547 per year OR $4,212 a Month

As you can see from our example, if you invest that 20% of your income ($1,000 a month) for 31 years, you can Safely Withdraw OVER $4,000 a Month! According to the 4% Rule, you’re set for life! Now if you do the math again with your actual income, I bet you’ll find you still have enough in retirement according to the 4% Rule. Don’t believe me? Use the Investment Calculator and find out for yourself!

Will it Work for You?

If it will work for you, the short answer is it Depends. As you can tell from the math above, if your save 20% of your income for over 30 years, you’ll be able to retire. If your financial goal is to retire in 30 years from now, this WILL work for you. This is assuming though you’re starting with no debt and the market is continuing to return at least 7% annually.

If you have a lot of outstanding debt, you’ll only reach the goal 30 years AFTER paying off the debt. You may need to reassess then. If you’re goal is to retire early, or before 30+ years from now, you will NOT save enough with the 50/30/20 Rule. In this case, you will need to Save a Higher Percentage of your Income.

The Wrap-Up

No matter what your goal is, you can learn a lot from applying the 50/30/20 Rule. Things to remember are;

The 50/30/20 Rule means Spending 50% on Needs, 30% on Wants, and 20% to Savings

If you Invest 20% of your income for 30+ years, you can Safely Retire according to the 4% Rule

You MUST Track your Spending and Savings to Effectively Budget your money

Being Conscious of where your money is going is Critical to Save Successfully for Any Financial Goal

Your goal should be to Save the Highest Percentage of your Income as is Comfortable

As always, everyone’s financial situation is different, but the 50/30/20 Rule is a great starting point, especially if you’re younger. If you’re not sure this rule is enough, it’s a good idea to reach out to a Certified Financial Planner for you’re own financial situation. Remember Financial Literacy is the Number 1 Key to Financial Success! Keep learning!

*Disclosure* This is NOT financial advice and I am NOT a Certified Financial Planner. All information is provided for educational purposes only and is not to be construed as advice. Everyone’s financial situation is different and requires individualized planning. Seek out a Certified Financial Planner for assistance with your own financial situation.